Providing Immediate & Impactful Solutions

We deliver dynamic keynote presentations and corporate financial wellness programs, to boost the performance of diverse professionals and small business owners.

As Featured In

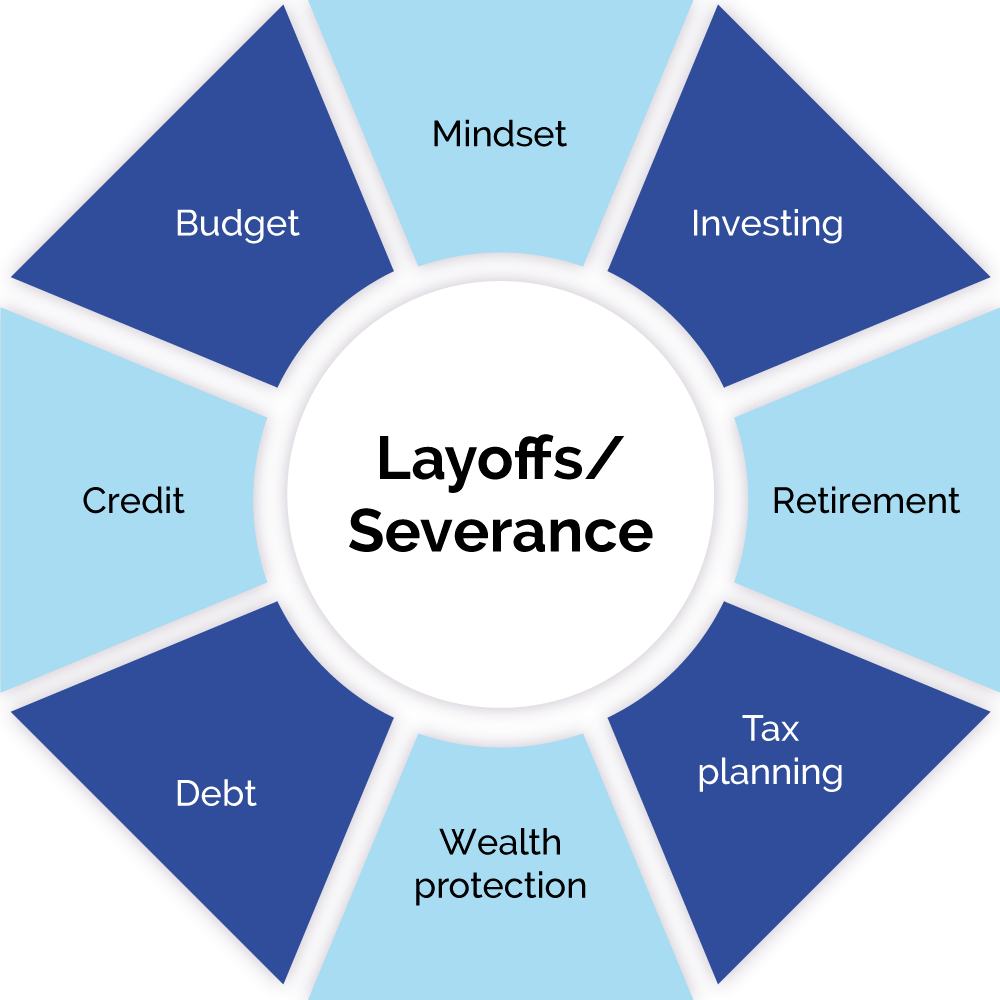

Our Specialization

financial wellness training

Tanya Tayor is an award-winning author, speaker, and the founder and CEO of Grow Your Wealth, a financial education platform which empowers individuals to overcome financial barriers and build wealth, by meeting them exactly where they are.

We serve a wide range of clients including Fortune 100 & mid-size companies, professional services firms, and non-profit organizations.

I also partner with BRG’s & ERGs to help support employees financial health.

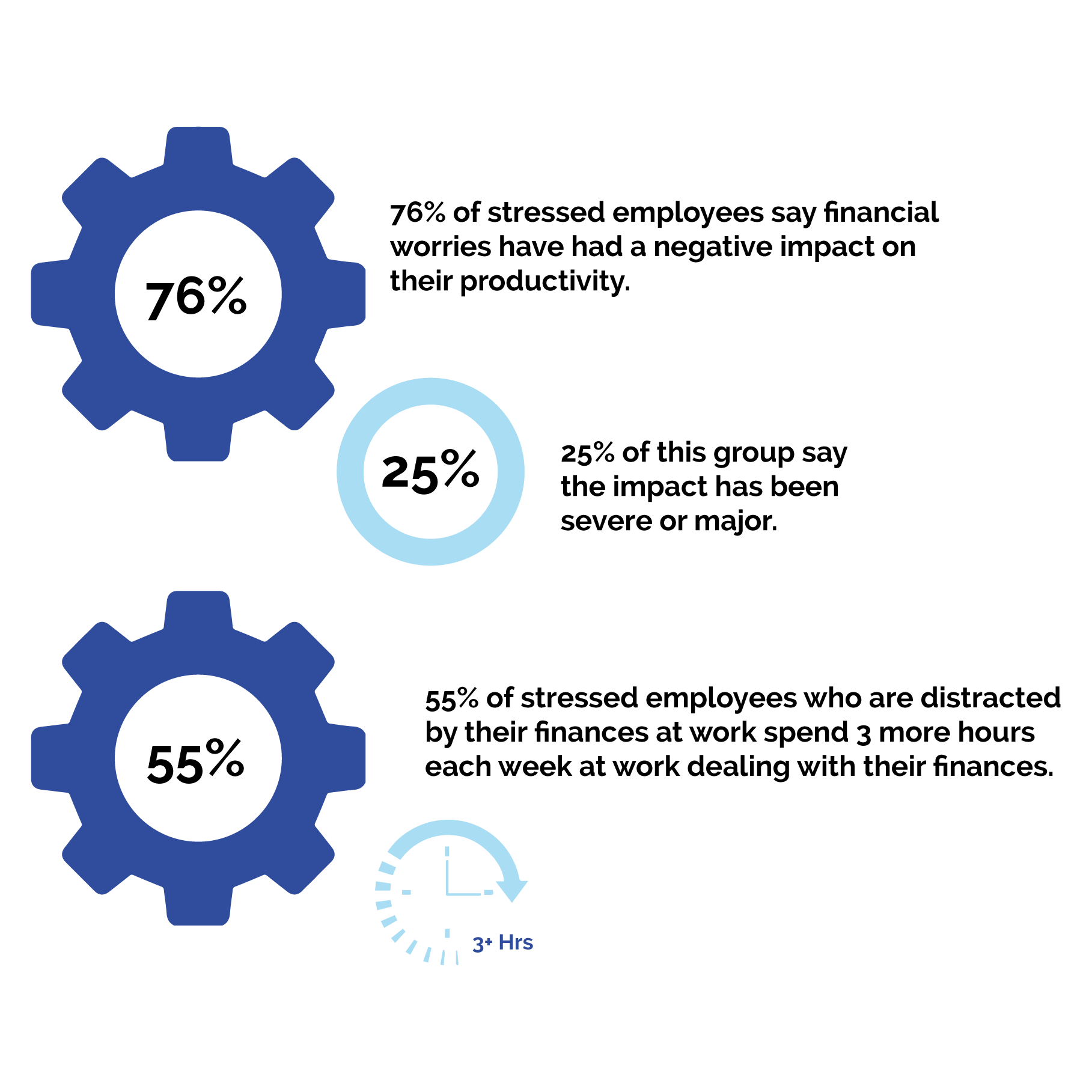

employee productivity

You have employee productivity problems because of financial stress

Employees across all income brackets are facing anxiety around a diverse set of financial worries.

- Do they have enough saved for an emergency – e.g. a layoff

- Will they have enough for retirement

- Mounting debt

- Lack of basic financial knowledge

The list is long and the fear is great!

When employee productivity is low, morale begins to take a nose dive and your organization's bottom line will inevitably be impacted.

It might be difficult to quantify the true cost, you don’t have to….

In these challenging times, the solution must be immediate, impactful and long lasting.

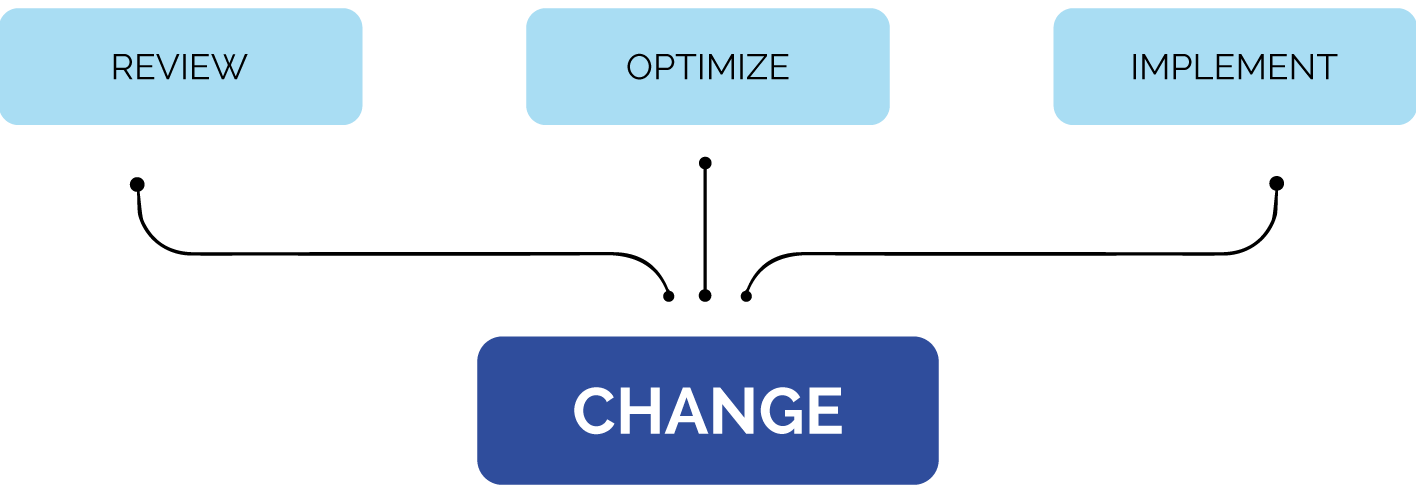

Using the ROIC method, we will help you to create financial wellness programs to improve your return on the most valuable assets in your organization – your employees

See how we can help you to increase revenue by reducing staff financial stress and improving their business performance.

Authentic and Actionable Delivery

Speaking

As someone who has suffered from financial anxiety and can relate to many of my audience’s fears, my goal is to paint a picture of authenticity. Removing any guilt and shame and leading them towards the realization that where they are today does not define where they will be in the future.

Result: Practical tips and resources to begin making immediate and lasting change.

Customized Learning

We have the flexibility to offer customized learning programs and materials for participants based on their specific needs with a group by first understanding what you as the client need. (e.g. helping clients navigate their finance after a layoff)

Result: Unique goal setting and roadmap towards achieving those goals.

Working with us can look very different for each organization and the needs of its employees. Facilitation of live or virtual workshops on specific personal finance topics, and self-paced online learning options.

Result: A change in the way your employees relate to and manage their finances.

Individualized Coaching

Our overall mission of one-on-one coaching is to help our clients use the specific tools within the program to achieve their goal at a faster pace and more direct and personalized help.

Result: Faster results leaving time to refocus on building a career and helping the business achieve or exceed its goals.

here is how to tell if we would be a good fit to partner together

Are We a Good Fit?

According to a PWC 2022 survey, “Personal financial issues impact employees physically, emotionally, mentally and socially-

You either believe the surveys about financial wellness or you don’t! If you believe them, then you know the impact on employees’ productivity, retention and ultimately your bottom line. Are you an employer who is ready to get ahead of the issue?

Yes we are a PERFECT match if you want to…

- You want to reduce employee stress.

- Improving employee morale and health is important.

- You want to increase your bottom line.

- You want to increase engagement and retain talented employees.

This will never work if…

- You are stuck in the old belief that financial education does not belong in the workplace.

- You are not willing to invest in your employee’s productivity retirement.

- You just want to check the box by skimming the surface.

- You are unwilling to track KPI.

Contact us for more information on Speaking Engagements, Consulting, Customized Learning and Individualized Coaching.

Relatable | Implementable | Transformational

Speaking

How can companies retain valuable employees, and improve productivity? The data doesn’t lie, and there are enough studies available to show that employees productivity is directly impacted by their stress level around their finances. According to a PWC survey, “Financial stress is a concern for employees at all income levels. Even among employees with an annual household income of $100,000 or more, 52% report feeling stressed by finances.” For far too long, financial wellness has been a taboo topic in the workplace – too sensitive and complicated . In the current environment, this problem will only continue to intensify – Let us help you bridge that gap

Start planning your custom Money Rehab program.

If your organization’s goal is to help your employees reduce financial anxiety, be more productive, and therefore elevate your revenues, this program is tailored to fit a variety of topics and lengths. It can be customized as an in-person or virtual keynote speech or workshop.

Although personal finance is often too heavy and feels too personal to discuss, we find ways to get attendees involved and to take away useful action steps.

Participants will leave my keynote understanding:

- Why they have a certain relationship with money

- An awareness of how that manifest in our life

- How to build a healthy relationships with money

- Wealth Building habits to begin implementing immediately after the event

What’s Your Money Story? The ABCD of Money

The ABCD of money. Just like a house needs a solid foundation, so does your wealth-building journey. Tanya’s honest and compelling story about how her 16 year old self, growing up in extreme poverty was able to shift her attitude towards money and got a well-grounded grip on your budget, credit and debt – The SMART Money Method – and how those tools together allowed her to start layering other pieces to allow her to invest and grow her wealth to 7 figures.

Participants will walk away from this keynote understanding:

- What is your ATTITUDE towards money and how to change it

- The importance of BUDGETING and how it allows you to build wealth

- The impact of negative credit and how to build and maintain a good CREDITscore

- DEBT paydown strategies and which one is right for you

5 Steps to financial freedom regardless of your income

We all have our own ideas of what financial freedom means and most of us see it as out of reach. The reality is that even in today’s environment, it is still very possible. In this talk we share 5 action steps that you should put in place that can help you to achieve financial freedom before you retire.

- The foundations of wealth building and why your mindset is your biggest barrier to wealth

- How to ladder up even by taking small steps

- The simple strategies to investing smart

- How to treat your wealth like a business